The current condition of the Dubai property market in 2024 is a topic of much discussion and conjecture. The real estate landscape in the emirate is developing and changing fast. It is crucial to be aware of dynamics, trends and factors that shape the property market to make the right decisions. This article offers an in-depth analysis of the property price movement and forecast in UAE, with a specific attention to Dubai.

Example of successful investment:

Our client earned $250,000 from buying real estate.

How it happened:

- The investor has been given a one-bedroom apartment from developer EMAAR in the Creek Harbour area by the developer during the construction phase.

- The property was sold at the price of 1,850,000 aed ($503,745).

- The apartment was completed within two years and we sold it for 2,800,000 aed ($762,426).

- The remaining amount of $258,681 is our client's net profit. Investing more than 52% of the amount.

2024 Property Price Trends in Dubai

The study of Dubai’s house price hikes is imperative to understand the behavior of the real estate market. Factors, including economic stability, government policies, and market demand, are some of the most significant trend shapers. Besides, some indices and reports may provide a complete picture of the price shifts and fluctuations in different parts of Dubai. Therefore, this analysis is indispensable for investors and stakeholders in formulating their decisions about property investments and market entry strategy. Let's take a look at the factors affecting changes in real estate prices:

- Oil industry: the UAE has had less volatility in oil prices over the past few years than before. The revenues from the oil and gas industry are approximately 30% of the total.

- Tourism: In 2023, the rise in tourist traffic was 19% more than the previous year.

- Financial sector: In 2023, the assets of the UAE banking sector surpassed the 2022 level for the first time in history.

The UAE banking sector marked a historical milestone when its total assets surpassed the $1 trillion mark for the first time. The sum of assets in the UAE banking sector exceeded $1 trillion for the first time in history, with a rise of 10.5% compared to the previous year.

Growth of 10.5% year-on-year.

Infrastructure projects

The City government of Dubai is very much committed to the infrastructural development and in particular:

- The cumulative efficiency of public investments of the government of Dubai the infrastructural development of road and transportation networks had reached up to AED 262 billion during 2006-2023.

- The Crown Prince of Dubai’s Emirate and Chairman of the Dubai Executive Council. His Highness Sheikh Hamdan bin Rashid Al Maktoum, Crown Prince of the Emirate of Dubai and Chairman of the Executive Council of Dubai, announced the start of a new initiative to establish a sustainable and environmentally friendly city. Project called the Dubai International Growth Initiative is being implemented.

This program with a budget of US$136 million and an area of focus will be to the small and medium-sized enterprises (SMEs).

Foreign investment

Dubai is purposely developing international cooperation. Some of the most ambitious projects in the world are done by the UAE.

Economic diversification

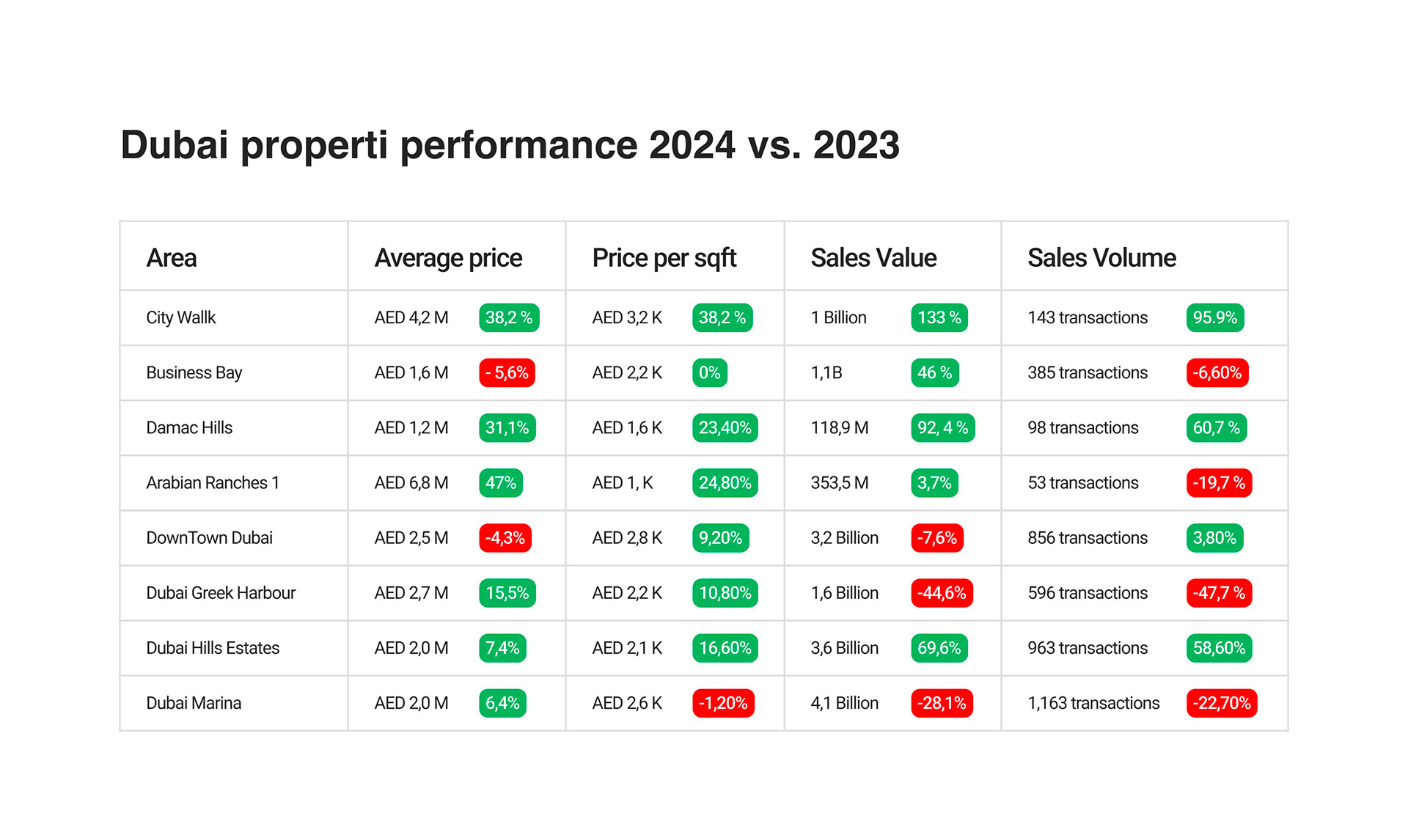

The UAE has a strategy to reduce dependence on oil and gas revenues by placing focus on development of other sectors like tourism, technology, education and health care. We see a reflection of the trends in Dubai Land Department data for the most popular areas:

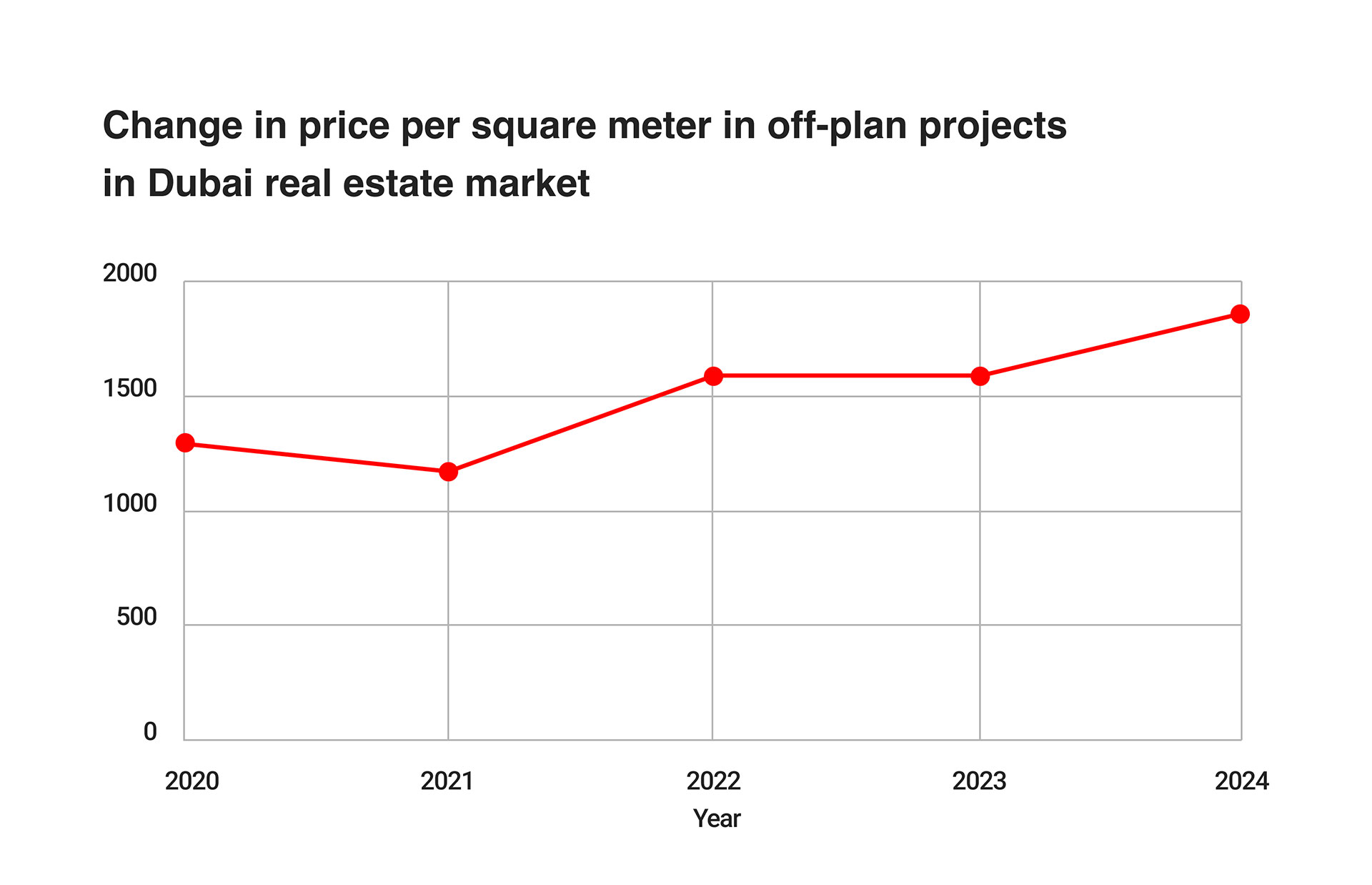

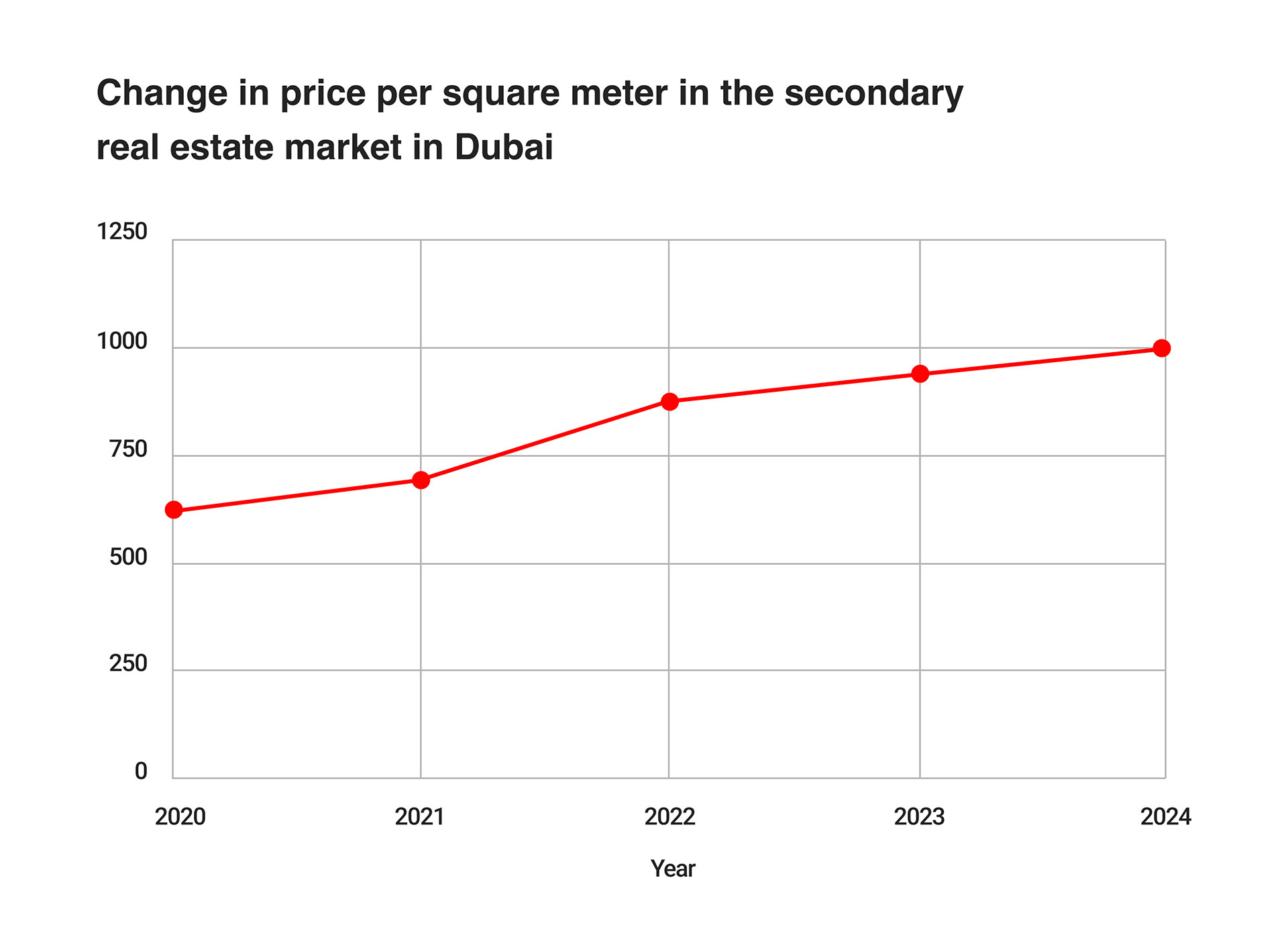

Introduction to the Dubai Property Market

The Dubai real estate market has a reputation for its agility and it is a place where both local and international investors are interested in. It covers a wide spectrum of real estate types, including apartments, villas, off-plan projects, and luxurious homes as you can find them in the Palm Jumeirah, the Downtown Dubai or the other famous neighborhoods. The market has experienced price growth for the last few years, and this was due to some factors that have shaped the market growth path. As you can see in the chart below, there was a slight drop in prices during the pandemic period, but from 2022 onwards there has been a steady increase again.

Growth Factors in the Dubai Property Market

A number of factors have been pivotal in the growth of the Dubai property market which include government initiatives, visa reforms, and ongoing infrastructure and amenities development. Moreover, the consultancy has given the forecasts for the property market in Dubai. These forecasts have offered a lot of analysis and projections, which are very helpful for the investors and the stakeholders to make the right decision in the face of the market dynamics and opportunities. The UAE National Strategy, the brainchild of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister of the UAE and Ruler of Dubai, is a seven-year action plan to steer the future of the country. It is built on the foundations of national identity, social interaction and the culture of UAE preservation. The strategy is goal-oriented and focuses on the happiness levels of the country and security in the society. The national strategy includes seven main objectives: The national strategy includes seven main objectives:

- Establishing the standards for governments of other countries and improving the UAE’s role as an international leader in intellectual services.

- Smart education for all schools and curricula and early childhood education should be prioritized in order to enhance investment.

- Besides, the government should develop programs that will lead to the UAE being the safest country in the world and decrease emergency services response times to a record 4 minutes.

- Raising the average income of the people by 65% in the next 7 years.

- The facilitation of projects to place the UAE at the head of the world in terms of the quality of airports, ports, roads and ease of doing business.

- Grant eligibility for housing to an applicant two years from the date of application.

- Increase the number of Emiratis to hold the posts in the private sector by 10 times.

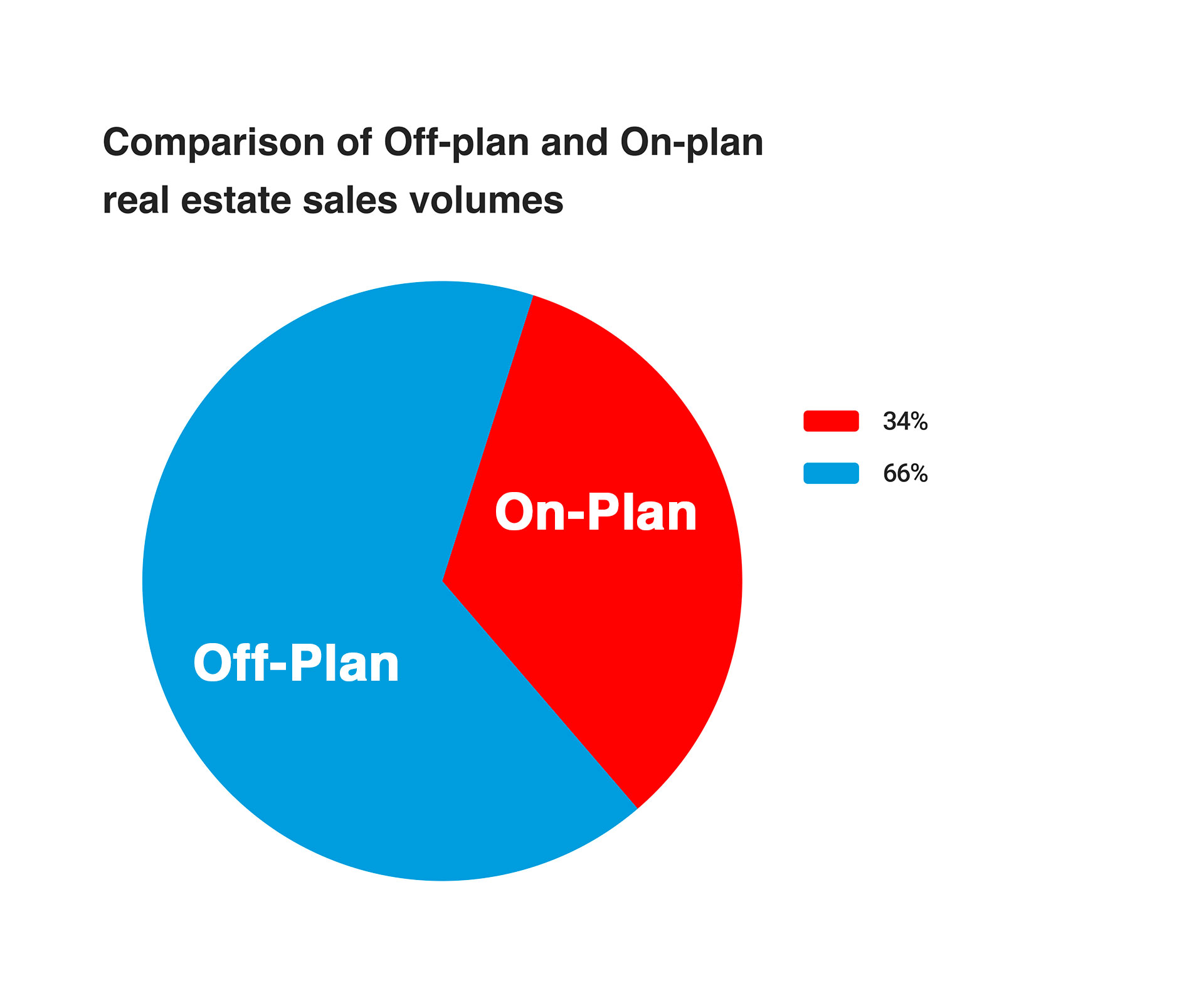

Off-Plan Properties and Market Expectations

Off-plan properties, which have become a popular choice in Dubai's real estate sector, offer investors the chance to pick up something unusual that shapes market sentiment. The knowledge about the off-plan properties in Dubai gives a better idea about the dynamics, risks and the potential gains that may be realized from investing in the pre-construction developments. Moreover, the economic analysis of Dubai property market will ensure that the market trends are predicted and investment strategies are well aligned with the market expectations. According to the Dubai Land Department (DLD), the volume of transactions for ready real estate was AED 111.1 billion, while for off-plan real estate was AED 213.7 billion.

If you choose the right off-plan project to invest in, you can make a profit of more than 80%, as in our client's case study: If you choose the right off-plan project to invest in, you can make a profit of more than 80%, as in our client's case study. The client had a profit of 83% on a one-bedroom apartment purchased in the EMAAR Beachfront area.

He bought a 1-bedroom condo in a building that was under construction for 3,100,000 AED (~ $844K). The apartment was sold successfully when the owners were given their keys for the sum of AED 5,700,000 (~ $1,552,081). The EMAAR beachfront is very much appealing to Dubai investors. Hence, the client managed to achieve the 83% return on investment or $707,967.

Expected Trends in the Real Estate Market in 2024

The anticipated trends in the real estate market in 2024 is based on a comprehensive study of economic factors, market drivers, and industry forecasts that define the real estate sector. The expected market trends give investors and the industry members a clear picture of the industry development, which in turn helps them to make decisions about their investment strategies, portfolio diversification, and risk mitigation. Knowing the forecasted trends in the real estate market in 2024 means making proactive choices and adjusting investment goals to be in line with market expectations.

Economic Analysis of the Dubai Property Market

The Dubai real estate market analysis goes beyond mere fiscal policies, regulatory changes, and macroeconomic indicators and looks at how they affect the real estate landscape. The economic analysis helps in the process of forecasting market trends, examination of the market’s resilience and identifying growth potential of different segments. Investors, developers and real estate professionals use economic analysis for making decisions, managing risks and taking advantage of the opportunities in a dynamic Dubai property market.