Dubai's rental market, an integral component of its real estate sector, has shown remarkable resilience, remaining buoyant amid global economic fluctuations. What keeps Dubai's market so dynamic even when global economic winds shift? The allure of Dubai as a cosmopolitan hub continues to fuel property demand, with rental prices reflecting the city's dynamic growth. The Dubai Land Department (DLD) data provides valuable insights into this trend, showcasing how rental contracts have evolved over time. In contrast, rental prices in Abu Dhabi present a different narrative, offering a comparative perspective within the UAE's property landscape.

State of Dubai's Rental Market

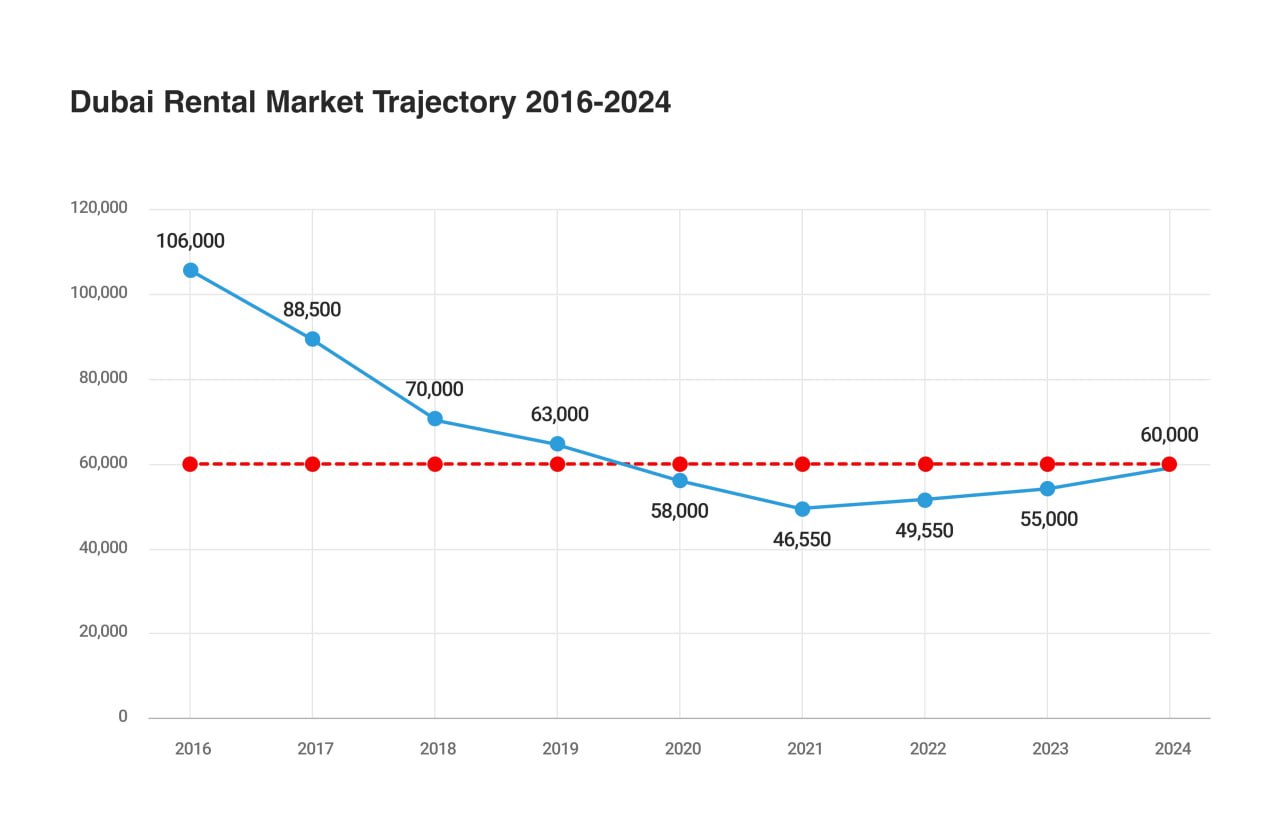

The trajectory of Dubai's rental market has been marked by its robustness and an unwavering demand. How has the market adapted to such diverse economic conditions? The data from DLD highlights a descending trend from 2016 to 2021, with a notable dip in average rental prices from AED 106,000 to AED 46,550, before gradually climbing back to AED 60,000 in 2024. This pattern underscores the market's adaptability to various economic conditions and consumer preferences that range from studio apartments to larger residential units. The rental market's ability to bounce back is evidenced by the Year-To-Date (YTD) figures, which demonstrate a dramatic increase in rental transactions to AED 477,701, indicating a burgeoning market with a high volume of activity.

Comparative Rental Prices: Dubai vs. Abu Dhabi

Why is there such a clear distinction in rental prices between Dubai and Abu Dhabi? A comparison of rental prices reveals that Dubai's cost of living, as of April 2024, is 20% higher than Abu Dhabi's, with rents in Dubai being 19.9% higher. Numbeo supports this with similar data, showing that consumer prices, including rent in Dubai, are 12.8% higher than in Abu Dhabi. Abu Dhabi's real estate market, while also experiencing growth, projects a more conservative increase in supply compared to Dubai, with around 8,000 units anticipated in 2024 against Dubai's 34,000. This difference in supply can partly account for the variance in rental costs, with Dubai's larger supply catering to a more diverse market demand.

Top Performing Areas and Transactions in Dubai

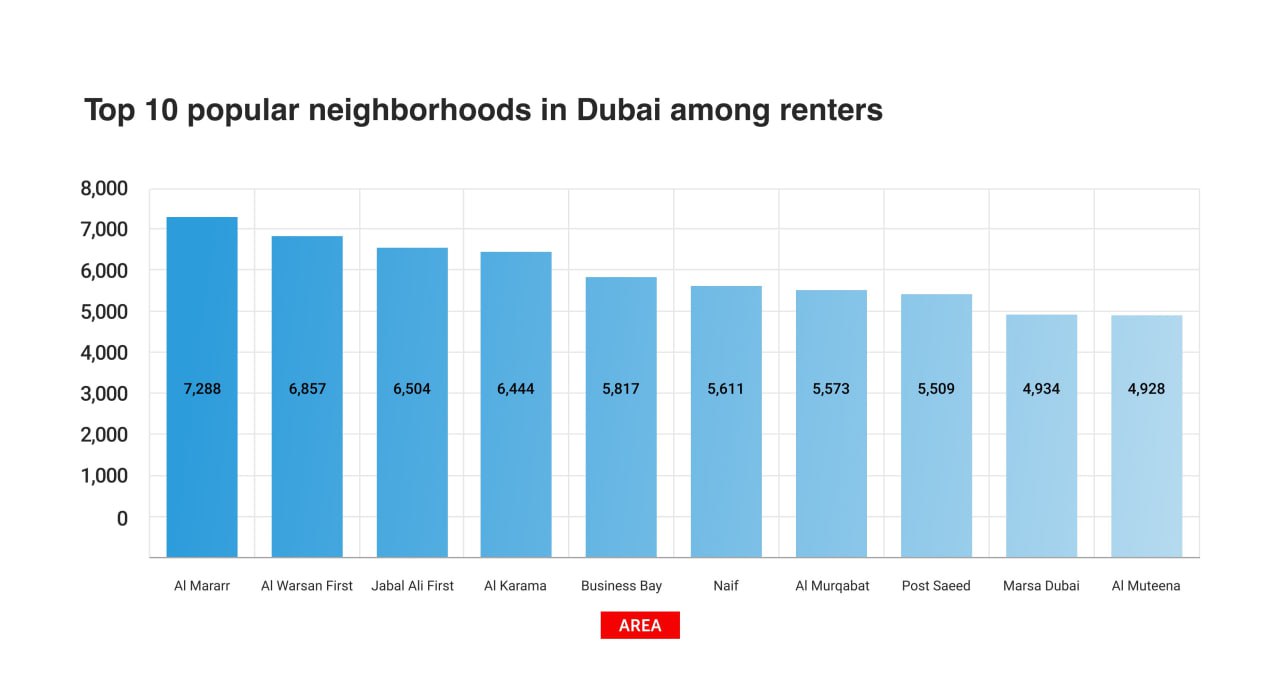

What makes certain areas in Dubai more popular among tenants than others? Analyzing the performance of various districts in Dubai, the DLD data exhibits a leading number of rental contracts in areas like Al Marrar and Al Warsan First, signifying their popularity among tenants. This distribution highlights the diverse appeal of Dubai's neighborhoods, offering a range of rental options to suit different preferences and budgets.

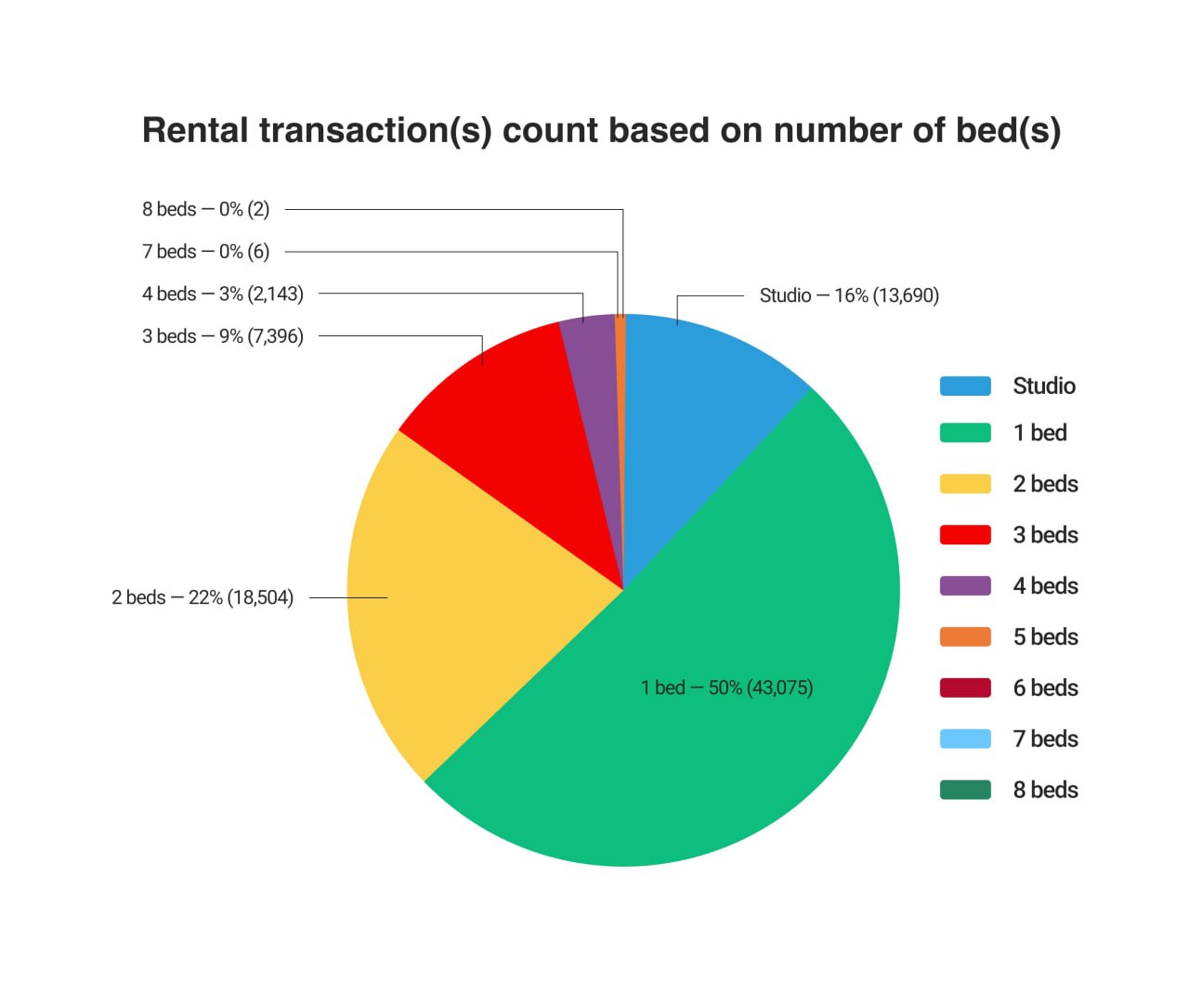

The transactional composition of the market also speaks volumes, with one-bedroom apartments constituting the majority (50%) of rental transactions. This suggests a significant demand for smaller units, possibly driven by singles and young couples, and underlines the changing demographics of Dubai's residents.

Annual Rental Market Overview for Dubai

As we reflect on the annual overview, how will the steady increase in rental prices from 2021 to 2024 affect the market's future? The rise in transactional value and volume points to a growing confidence among investors and tenants alike. This upward trend is expected to stabilize as the market adjusts to the new normal post-2024, paving the way for a balanced and sustainable growth trajectory.

Abu Dhabi's Rental Market Outlook

Can Abu Dhabi's rental market keep pace with Dubai's rapid development? Abu Dhabi's rental market, while smaller in scale, presents a similar pattern of growth with a substantial increase in transaction values and volume, particularly in the off-plan segment. This suggests that Abu Dhabi's market is catching up, with new developments likely to bolster its rental landscape in the coming years.

Conclusion

How should investors and tenants interpret the comparative analysis of rental prices and market trends in Dubai and Abu Dhabi? The insights from the DLD and various market reports offer valuable guidance for those looking to navigate the complex dynamics of this vibrant market. As the region continues to expand and diversify, the rental market in both emirates is poised for sustained growth and innovation.